Inflation is back in America and that’s a problem for bitcoin (at least in the short term). After the “hot inflation figures” of January and February, there were still doubts, but it is now clear that inflation is really a problem again.

Some people are already concerned about a double peak like we saw in the United States in the 1970s.

Almost everyone had expected that the US central bank’s (Federal Reserve) aggressive interest rate hikes would be enough to get inflation under control. Unfortunately, that is not the case and the American economy continued to perform so strongly that inflation is now boosting again.

On Friday we received confirmation that new price increases are a fact with the Core PCE inflation, the Federal Reserve’s favorite inflation gauge. Core PCE inflation came in much higher than expected. In addition, geopolitical tensions in the Middle East and Ukraine are also causing higher oil prices.

Although I do not expect inflation to return to the 10 percent level, it is quite possible that we will remain between 3 and 4 percent for a long time to come. That in itself is enough to cause a lot of misery.

What will the Bitcoin halving mean for the price?

-

Columns

Receive a free Financial Newsletter?

Do you want to easily stay informed of all important developments in the financial world and learn more about the economy?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,000 people went before you!

Each Monday and Thursday you will receive everything you need to know about the financial markets directly in your mailbox.

Where lies the problem with inflation?

The focus of many analysts when it comes to inflation is on oil prices, but the chart below shows that agricultural products delivered the largest “returns” from the start of 2024. Price increases for agricultural products are even twice as high as those for oil and precious metals, numbers two and three.

Why is that a problem? This is a problem because food is a basic necessity and consumes a large part of the monthly budget for many families.

Michael Gayed of The Lead-Lag Report shows the link between agricultural product prices and US interest rates with the graph above.

What we see is that interest rates rise when prices for agricultural products increase (and vice versa). Based on this, the Federal Reserve may have to intervene and even raise interest rates again to get this situation under control.

Bitcoin on its way to $1 million: here’s why the price doesn’t deserve to worry

-

Columns

What does this mean for the bitcoin price?

This rebound in inflation means that the US central bank may not wait until December 2024 to implement the first interest rate cut. New interest rate increases are very unlikely at the moment, but certain analysts are starting to speculate about it.

In the short term, these developments are not good for bitcoin and the rest of the risk asset market (think the S&P 500 and the Nasdaq 100). The financial market benefits from lower interest rates, at least if you hope for price increases.

In that respect, this development is anything but good for the bitcoin price. It also creates a lot of uncertainty, because how long can the American economy continue to bear these high interest rates? This week we suddenly got the news that US economic growth for Q1 2024 was about 50 percent lower than expected.

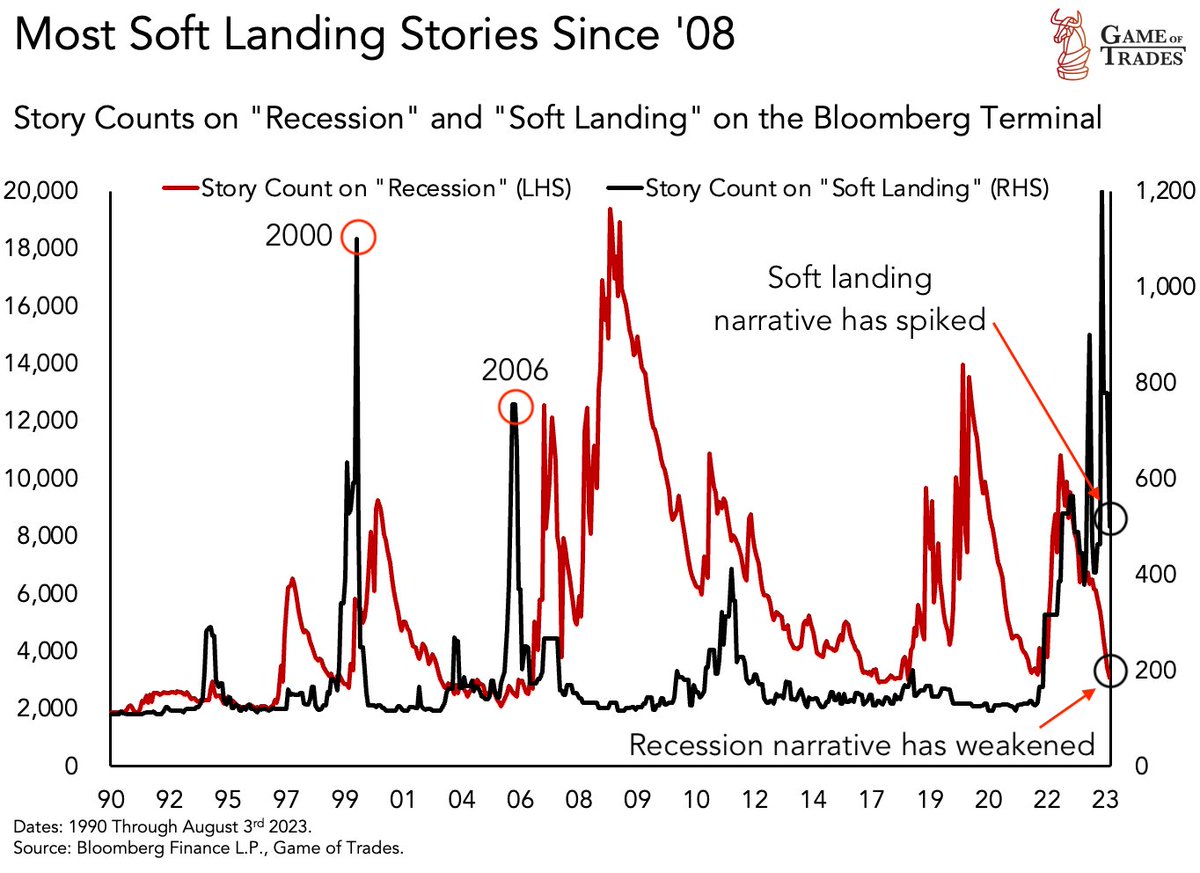

In any case, it is clear that the market was far too optimistic in their expectations of a “soft landing” for the US economy. As it stands now, the US central bank is “not going to land” and we just have to see what this ultimately turns out to be.

By the way, this development is not necessarily bad for bitcoin in the long term. In the long term, delaying interest rate cuts will put financial pressure on the US government. They are struggling with a debt of ~35 trillion dollars and the longer interest rates remain at this level, the more interest they have to pay on those debts.

Of course, those interest payments cut into the budget, forcing them to close deficits with even more debt. In this financial system, debt creation is equivalent to money creation, which means that in the long term this development will be at the expense of the US dollar.

Investors will smell this too and may flee to assets with natural scarcity, such as bitcoin, gold and shares.

Post Views: 579