The AEX index is expected to open 0.3% lower after Wall Street started the day without direction and Meta fell mercilessly after the close. No fewer than six major companies just opened their books. And there is takeover news: according to the Bloomberg news agency, mining group BHP has made a takeover bid for British archrival Anglo American.

Disappointing order inflow Besi

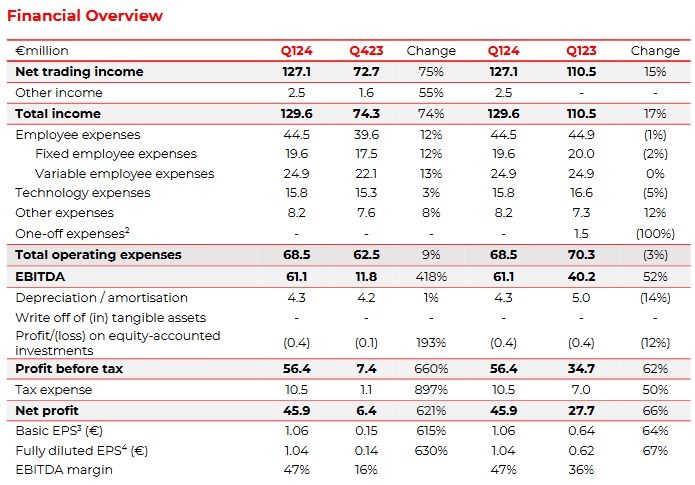

BE Semiconductor Industries was the last chipper to present quarterly figures and these do not seem to be too bad. The company met the outlook, but the order inflow disappointed. The group had received €127.7 million in orders: 23.3% less than in Q4. Analysts expected €183 million. The market for smartphones and automotive was particularly weak, according to CEO Richard Blickman. Here the numbers:

Adyen sees turnover increase by 21%

Adyen achieved significantly higher volumes and turnover in the first quarter. The processed payment volume increased by 46% and at €297.8 billion was much higher than the €281 that analysts had expected. It is lower than in Q1, when Adyen reported €301 billion in processed payment volume.

Sales increased 21% year-on-year to €438 million, but at constant exchange rates sales were unchanged. Adyen spoke of ‘momentum’ in North America, which remains the fastest growing region.

Fugro benefits from offshore wind farms

The growth of offshore wind farms is benefiting Fugro. The company reported comparable sales growth of 9%. EBIT increased from €25.3 million to €44.2 million and the margin increased considerably from 5.4% to 8.8%.

… Bitcoin ETF Flow Traders

Flow Traders has to rely on volatility and that was hard to find on the stock markets in the first quarter. Nevertheless, the group saw a sharp increase in profit in the first quarter. That was due to the approval for the launch of bitcoin ETFs in the United States. That has significantly increased trading volumes and the strong volatility in the bitcoin market also helped.

Net trading income rose by 15% and net profit increased by a whopping 66% year-on-year, while Q4 still saw a profit decline.

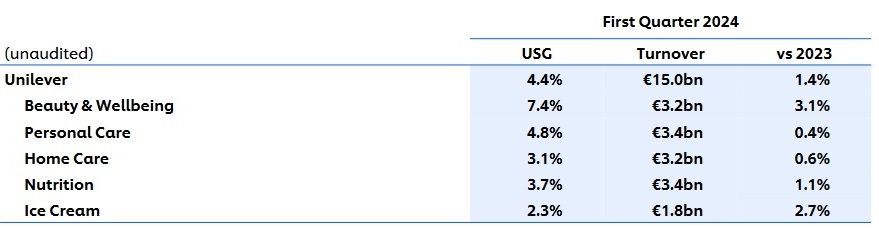

Unilever turnover growth leveling off

Unilever’s turnover grew less rapidly in the first quarter compared to Q4 2023, but it was better than analysts expected. Turnover rose sharply on an underlying basis, especially in the Beauty & Wellbeing branch:

Last month, Unilever announced that it wants to accelerate growth by spinning off the ice cream division.

Meet the CEOs of Unilever and Flow Traders at the IEX Investor Day 2024

Did you know that you can meet Mike Kuehnel, CEO of Flow Traders, and Hein Schumacher, CEO of Unilever, in a few months? They will appear at the IEX Investor Day in Bussum on Friday, June 28, and will then explain their vision. The CEOs of TKH and NN Group will also speak.

Order your tickets quickly and benefit from an attractive early booking discount! Be quick, because ticket sales are going fast and capacity is limited.

Want to know more about the IEX Investor Day? View the website now.

RELX reiterates forecast

Finally, data company RELX released a trading update. Not much could be deduced from this, because no concrete figures were given. The company expects another year of strong underlying revenue and adjusted operating profit growth, in addition to strong adjusted earnings per share growth, at constant exchange rates.

Huub huub, OCI trick

It does not happen often that a shareholders’ meeting leads to parliamentary questions. But today the time has come, at OCI, that an extraordinary shareholders’ meeting is convening for an amendment to the articles of association.

OCI wants to return several billion euros to shareholders as a result of the sale of OCI’s stake in Fertiglobe. The fertilizer manufacturer wants to first increase the share capital (by €2.7 billion) and immediately afterwards reduce it again (by the same amount). This trick should ensure that OCI can distribute €2.7 billion tax-free to shareholders.

It is not the first time that OCI has used this trick: the same thing happened in the previous two years. If shareholders give the green light for the amendment of the articles of association this afternoon, OCI will have paid out a total of €5 billion tax-free over the past three years. According to the NRC newspaper, this means that the Dutch tax authorities will miss out on €750 million.

MPs from GroenLinks-PvdA and D66 have now urgently requested clarification from State Secretary Marnix van Rij of Finance. To be continued. More information about this construction can be found here.

Asia is taking a step back

Several Asian stock markets took a step back after two days of gains. The shock reaction to Meta Platforms’ outlook, profit-taking and persistent concerns about US interest rates remaining high for longer may have played tricks on the stock markets. In Japan they are anxiously awaiting the outcome of the Bank of Japan meeting, which will be announced tomorrow. Interest rates are expected to remain the same, but further interest rate increases cannot be ruled out.

Here are the positions of the most important indices at a glance, clocked at 7:45 am:

- Nikkei 225: -2.1%

- TOPIX (Japan): -1.4%

- Shanghai Shenzhen CSI 300: +0.2%

- Hang Seng (Hong Kong): +0.4%

- Kospi (South Korea): -1.3%

Several tech stocks were under pressure:

- Samsung -2.3%

- Alibaba: +1.2%

- Baidu: +0.1%

- Prosus stake Tencent: -1.6%

- TSMC: -2%

Wall Street closes flat on a packed earnings day

Wall Street was flooded with quarterly figures on Wednesday, but didn’t really know what to make of them. In the end, the three most important indices remained close to home:

- S&P 500: unchanged at 5,071.67 points

- Dow Jones index: -0.1%

- Nasdaq: +0.1%

The quarterly figures were received mainly positively. The main prize went to Tesla (+12%). The electric car manufacturer presented a disappointing set of figures, but the announcement that it wants to produce cheaper cars made up for everything.

Tesla must share the price with games manufacturer Hasbro (+11.8%), which achieved more profit than expected, while turnover fell less than expected.

Texas Instruments with a share price increase of 6%, there is no reason to complain either. The group saw profits and turnover decline due to weak demand, but investors had expected worse and – more importantly – the outlook was better than expected.

Also AT&T (+2.5%) and Visa (+1%) were rewarded for their quarterly results. Boeing on the other hand, it suffered a 2.6% price loss. The loss was smaller than analysts had expected, but money is literally flying out of the company due to compensation amounts that the company has to pay to airlines due to a series of technical defects.

Meta sees $200 billion in market value evaporate in after-hours trading

Opened after Wall Street closed Meta Platforms (parent company of Facebook) and IBM the books. Meta saw its net profit more than double, while turnover increased by 27%. Yet in after-hours trading it fell by more than $15, causing about $200 billion in stock market value to go up in smoke. Sales expectations were disappointing. And investments in AI and the metaverse will cost the company a lot of money, as Mark Zuckerberg’s talk showed.

IBM In addition to figures, it also announced the acquisition of cloud software company HashiCorp for approximately $6.4 billion. Sales rose 1.4% and net profit rose 70% to $1.72 per share. On an adjusted basis, earnings were $1.68 per share. Profit was therefore higher than expected and turnover slightly lower. This share also fell sharply in after-hours trading: -8.5%.

The indicators:

- The European stock markets are heading for a lower opening.

- Mostly red rates in Asia tonight.

- The ‘panic barometer’, the CBOE VIX index (indicator of volatility), rose slightly to 15.97.

- The euro is still in dreamland and is trading at 1.0702 against the dollar.

- The Dutch ten-year interest rate is 2.83%. The ten-year yield on US government paper is 4.657%.

- The gold price is fractionally higher at $2,318 per troy ounce.

- Oil prices are under some pressure. For a barrel of WTI you now pay $82.89. A barrel of Brent oil from the North Sea now costs $88.08.

- A significant loss for bitcoin: 2.7% off at $64,558.77.

The AEX is expected to open 0.6% higher.

News, advice, shorts and agenda

IEX also produces an overview of the most important news in the morning newspapers every morning. The complete news overview can be found here.

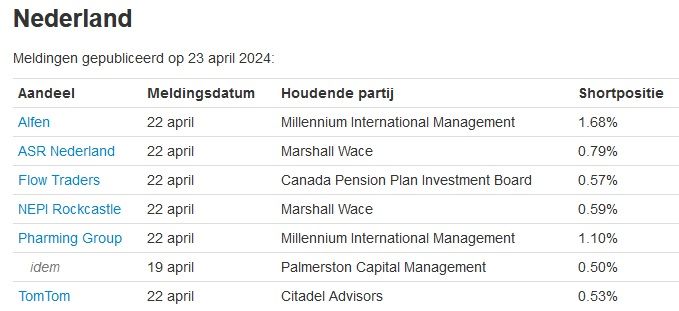

The AFM reports these shorts.

Advisory increase for AkzoNobel

- Euronext: to €108 from €106 and buy – Citi Research

- AkzoNobel: to €70.00 from €68.50 and sell advice makes way for hold advice – JPMorgan

- Unilever: to 3,510 pence from 3,430 pence, but advice continues to sell – UBS

- Randstad: to €52.00 from €54.40, but advice continues to buy – Morgan Stanley

- Aegon: to €7.00 from €6.60 and buy – Berenberg

Agenda: US GDP, Microsoft, Alphabet and Intel

Adyen, Besi, Unilever, Relx, Flow Traders, Fugro, BASF, Deutsche Bank, JET competitor Delivery Hero, Nestlé and Barclays have already visited this morning. After lunch Caterpillar and Merck follow. But be sure to stay awake tonight, because then Magnificent 7 shares Alphabet and Microsoft will open the books, as well as chip giant Intel and social media company

WDP real estate share goes €1.12 ex-dividend. OCI convenes a now controversial extraordinary shareholders’ meeting.

The most important macro figure today is the growth of the US economy in the first quarter. In the fourth quarter, GDP still grew by 3.4%. Economists expect this to have weakened slightly to 2.5% in Q1.

There is also another interest rate decision on the agenda: from the Turkish central bank. The new central bank governor, Fatih Karahan, unexpectedly raised interest rates to as much as 50% last month in an effort to quell hyperinflation. Previous attempts have so far yielded little: inflation has now risen to a staggering 68.5%.

Here is the full agenda for the rest of the day:

- 09:00 WDP €1.12 ex-dividend

- 09:00 AkzoNobel annual meeting

- 09:00 Heineken annual meeting

- 09:00 Hydratec annual meeting

- 09:00 OCI extraordinary shareholders meeting

- 09:00 Vastned – Annual meeting

- 1:00 PM American Airlines first quarter results

- 1:00 PM Caterpillar first quarter results

- 1:00 PM Comcast first quarter results

- 1:00 PM Dow first quarter figures

- 13:00 GE Vernova first quarter results

- 1:00 PM Harley-Davidson first quarter results

- 13:00 Merck first quarter results

- 13:00 Turkish Central Bank – Interest rate decision

- 2:30 PM US aid applications – weekly

- 14:30 US economic growth first quarter (provisional)

- 4:00 PM US upcoming home sales in March

- 22:00 Alphabet first quarter results

- 10:00 PM Intel first quarter results

- 10:00 PM Microsoft first quarter results

- 22:00 Snap first quarter figures

You’ve caught up again. Good luck and above all have fun today!