NOS News•today, 06:52

-

Charlotte Klein

editor Mobility

-

Charlotte Klein

editor Mobility

There are no longer any parking spaces available at the car terminals of ports, various (inter)national news media have written in recent weeks. The conclusion is that it is all due to the rise of the electric car from China. And that too while demand is already declining. That is of course why all those terminals are so full. But it is more nuanced.

There is indeed something going on in the electric car market. Last week it was announced that Tesla, for example, will lose 10 percent of its jobs after disappointing sales figures. Hundreds of jobs have also been cut at Polestar. In February, ElaadNL predicted that the growth of the electric car market will slow down somewhat.

But this knowledge center may expect growth to stagnate in the short term, but that does not matter in the long term. Car manufacturers are already fully committed to it, batteries are becoming better and cheaper and in China – an important player – the choice for electric has long been made.

That does not mean that the market is already being stormed by Chinese brands. The Chinese car market is knocking softly on Europe’s door, but there is no question of flooding: the market share is still very small.

China would like to see that change. Chinese brands ship cars to Europe, and they often enter the market via Belgian and Dutch ports.

The Chinese work differently than many European brands. The latter produce cars to order from car dealers, among others. Chinese brands (and the American Tesla) have production, assembly and sales all in their own hands. They produce according to their own wishes and their supply is therefore less tailored to demand.

The port is therefore seeing an increase in brands that no longer have showrooms, but deliver their cars directly to the customer. “Those cars therefore spend longer in the port waiting for a buyer, which aggravates capacity problems, but does not cause them.”

3.5 million cars in a port

Because the hustle and bustle at the ports does not seem new at all – at least not in the Belgian Zeebrugge, the largest car port in the world. Last year, 3.5 million new cars passed through there.

“This is not a new problem, but has been going on for years,” the spokesperson said. “For example, there are too few drivers to take the cars to the right garage and there are too few ships and crew for a good flow of ‘short stay’: cars that would quickly cross to the United Kingdom. And we are at the right level in terms of numbers not even at pre-corona levels.”

There are also more waiting cars in Dutch ports – although the big three, Amsterdam, Rotterdam and Vlissingen, say that there is not really a problem. The port of Rotterdam, traditionally a port for Korean and now also Chinese brands, sees that slightly more cars arrive than leave, but the car terminals absorb this by arranging extra parking spaces outside the port. This cannot be checked at the terminals themselves: approached car terminals do not want to respond for commercial reasons.

Motor vehicle tax will increase more slowly

The Dutch buyer then. The car industry and lobby clubs for electric driving have long been making a point about the benefits that will probably be phased out completely, but it is unclear whether that will actually happen. According to the industry, the market is not yet sufficiently strong to stand on its own without decoys.

One of those tax benefits is an exemption from motor vehicle tax (MRB). Electric car drivers would actually pay the same tax as fossil fuel cars from next year, but last week’s Spring Memorandum showed that the outgoing cabinet will increase the tax more slowly in the coming years than planned.

Motor vehicle tax for electric cars (source: Spring Memorandum)

| percentage of motor vehicle tax (compared to petrol cars) | |

| 2024-2025 | 0% |

| 2026 | 60% |

| 2027-2029 | 70% |

| 2030 | 75% |

| 2031 > | 100% |

In exchange for the extension of the MRB exemption, the purchase subsidy of 2,000 euros for a second-hand electric car was canceled: it ends this year. The exemption from the purchase tax (bpm) of an electric car still applies this year.

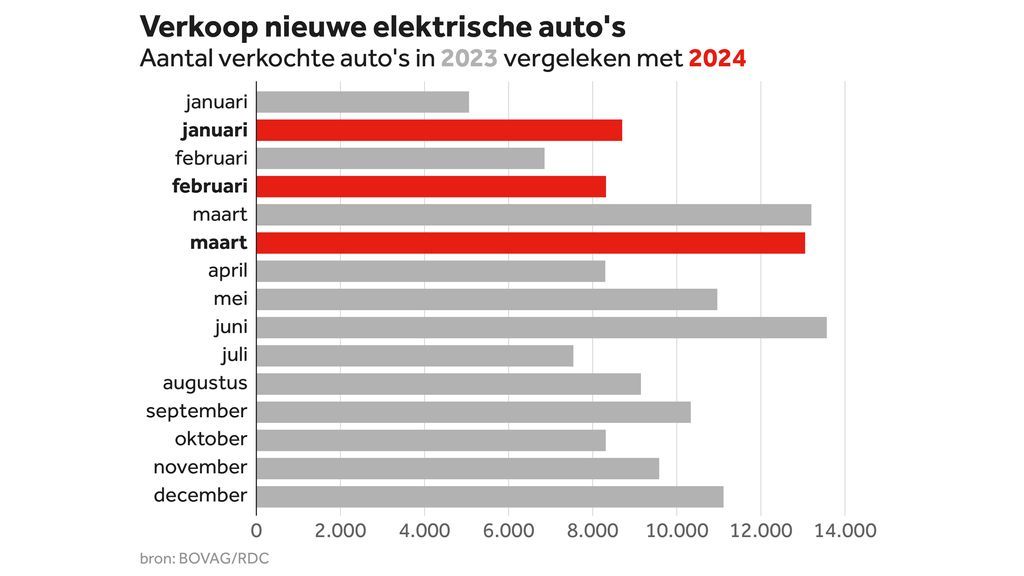

So some of the benefits disappear, some have been extended. Do we see the uncertainty that continues to plague the industry reflected in the figures? No. De Bovag continues to observe growth. “There’s just demand and growing supply.”

In short, the soup is not eaten as hot as it is served. There is indeed an increasing and changing supply, but the market share of Chinese brands is still very small. The capacity problem at the car terminals is multi-faceted and in the Netherlands there is not (yet) a real decline in demand.