The AEX index is once again heading for a higher opening, while a flood of figures is being poured out across the stock exchange floor. Investors are inspired by Wall Street and Asia, where prices rose across a broad front.

There is no shortage of news. Four companies have just submitted figures and last night it was ASMI’s turn. We walk past them quickly.

Vopak increases outlook

Vopak has increased its outlook for 2024 due to the strong demand for storage space for oil and gas. The tank storage company now expects an Ebitda in a range of €900 to €940 million, while the group previously expected €880 to €920 million. Quarterly revenue fell by 9.4% year-on-year to €328 million, which is slightly less than analysts expected. But adjusted for divestments, turnover did increase. The Ebitda actually came in at the top end of the consensus and the net profit was also higher than expected.

…and KPN also does that (a little)

KPN is also raising the forecast slightly after the takeover of Youfone. The telecom company is now targeting an adjusted Ebitda after leases of €2,500 million (from €2,480 million) and a free cash flow of €890 million (from €880 million).

Adjusted Ebitda after leases rose 3.6% year-over-year to €605 million this quarter, slightly better than analysts expected. Profit fell by 10.7% on an annual basis, but according to KPN this is due to one-off refinancing costs. KPN itself speaks of a ‘solid start to the year’.

Heineken reiterates outlook

Heineken came with a trading update. Turnover increased by 7.2%. Beer volumes rose organically by 4.9%, but that of premium beer rose a lot faster: by 7.3%. The forecast for the rest of the year is unchanged. Operating profit is expected to show low to high single digit growth.

Wereldhave sees debt ratio falling and maintains outlook

Wereldhave saw its debt ratio fall further to 41.5%, compared to 42.7% at the end of 2023. Gross rental income increased by 9.5% on an annual basis, but the direct result per share fell by 11.8%, due to, among other things, the impact of refinancings. Nevertheless, the real estate company repeats the forecast for the rest of the year of a direct result per share of €1.75.

ASMI surprises

ASMI released the figures after hours yesterday. Turnover came in at €639 million at the top end of the forecast, but it was mainly the order inflow and margin improvement that seemed to surprise in a positive way. Orders amounted to €698 million: about €20 million more than analysts had predicted. And the gross margin came to 52.9%, while the market had expected 48.3%.

Problems again at Philips… now with CT scans

Jefferies reported that Philips received a warning from the US FDA two months ago about quality issues with CT scanning systems from a factory in China. The healthcare technology group also allegedly failed to report adjustments made after certain problems. It seems like small beer, but it once again sows doubt that Philips does not have its processes in order.

Tech in Asia is on its way up

Following Wall Street, the price boards in Asia also turned green and here too, it was mainly tech shares that were in the interest of bargain hunters. It was mainly the tech-heavy indexes (the Japanese Nikkei 225, the Hang Seng in Hong Kong and the South Korean Kospi) that found their way up.

Chinese EV bakers hitched a ride on Tesla’s share price rise. And TSMC appeared to benefit from the recovery of Nvidia, one of the company’s most important customers.

Here are the positions of the most important indices at a glance, clocked at 7:45 am:

- Nikkei 225: +2.3%

- TOPIX (Japan): +1.6%

- Shanghai Shenzhen CSI 300: +0.1%

- Hang Seng (Hong Kong): +2%

- Kospi (South Korea): +2%

Nice price gains in the tech sector:

- Samsung +4.1%

- Alibaba: +3.7%

- Baidu: +1.5%

- Prosus participation Tencent: +2.1%

- TSMC: +4.1%

Wall Street higher across a broad front

Wall Street closed higher for the second day in a row. The fear of further escalation in the Middle East is subsiding somewhat and the quarterly figures were mainly received positively. In particular, many tech shares that were sold before the weekend were in great demand. That’s how it went Nvidiawhich saw more than 13% of its stock market value evaporate last month, 3.6% higher on the day. Super Micro Computer, which fell by 23% on Friday, regained 6.3% last night. And we can go on like this for a while.

Here are the final positions:

- S&P 500: +1.2%

- Dow Jones index: +0.7%

- Nasdaq: +1.6%

As mentioned, most of the figures were received with cheers. This is especially true for the Swedish music streaming service Spotifywhich saw its share price shoot up 11.5% on Wall Street, due to a combination of growth in revenue and number of users and a better-than-expected margin. General Motors (+4.3%) was generously rewarded for an outlook increase and better than expected figures. Also the results of parcel service UPS (+2.4%), cigarette manufacturer Philip Morris (+3.9%) and diaper and tissue manufacturer Kimberly Clark (+5.5%) were well received.

Only Lockheed Martin (-0.4%), PepsiCo (-2.7%) and Halliburton (-0.3%) were unable to make any progress.

Tesla’s price shoots up in after-hours trading

After the fair, three more companies submitted figures, including: Tesla attracted the most attention. The electric car manufacturer saw turnover and profit decline more than expected, but the price still shot up 13.4% in after-hours trading.

While Tesla has been having a hard time on all sides lately. There were production disruptions in Berlin due to a shortage of parts due to attacks by Houthi rebels in the Red Sea and a fire at the factory set by environmentalists. Car sales were disappointing. And the company – like several other automakers – was forced to lower prices in the US. To top it all off, 10% of the staff is allowed to look for other work. The company reiterated that volume growth in 2024 would be much lower than in 2023.

Source: CNBC

But it looks like Elon Musk has talked the stock price up. In the conference call he said that Tesla will start producing cheaper EVs in early 2025. There was some doubt about that for some time. Images of a robotaxi, which will be called ‘Cybercab’, were also shared.

Beautiful views, but that doesn’t keep the chimney from smoking. Let’s wait for the numbers first.

Also Texas Instruments got investors on the banks. Turnover and profit were under pressure due to weaker demand for chips from industry and the automotive sector. But the results were better than expected. The price shot up by 7.7% after hours.

Compared to this, the after-market price increase of 2.2% is favorable Visa modest. Consumers are still spending a lot of money and the credit card company benefits from this. And also more than analysts expected.

The wait is now mainly for Big Tech companies. Tonight it is IBM and Meta’s turn and tomorrow the quarterly figures are due for Intel, Microsoft and Alphabet.

The indicators:

- The European stock markets are once again heading for a higher opening.

- Green prices in Asia tonight.

- The air seems to be running out again when we look at the panic barometer, the CBOE VIX index (indicator of volatility). It has now dropped to 15.69.

- The euro is still in dreamland and is trading at 1.0702 against the dollar.

- The Dutch ten-year interest rate does not do much and is trading at 2.75%. The ten-year yield on US government paper rises to 4.62%

- The gold price rises by 0.4% to $2,330 per year troy ounce.

- Black gold is also on the rise, albeit at a modest pace. For a barrel of WTI you now pay $83.44 (+0.2%). A barrel of Brent oil from the North Sea now costs $88.45.

- Digital gold is more than 1% higher at $67,057.55.

The AEX is expected to open 0.6% higher.

News, advice, shorts and agenda

IMCD makes an acquisition. And further:

- 08:14 Higher opening AEX expected

- 07:47 KPN increases outlook slightly

- 07:39 Significant price gains in Asia

- 07:35 Vopak raises outlook

- 07:32 IMCD takes over Spanish Cobapharma

- 07:19 Wereldhave maintains outlook

- 07:00 European stock markets are expected to open higher

- 06:53 Stock market agenda: foreign funds

- 06:53 Stock market agenda: macroeconomic

- 06:52 Exhibition agenda: Dutch companies

- April 23 Stock market update: AEX on Wall Street

- Apr 23 Texas Instruments exceeds profit target

- Apr 23 Wall Street closes higher

- Apr 23 Visa payment volume is growing

- Apr 23 Tesla profit and turnover lower than expected

- Apr 23 Oil price rises

- April 23 Wall Street is gaining ground again

- Apr 23 FDA warned Philips about Chinese CT scanners

- April 23 Flow Traders nominates Owain Lloyd as CTO

- Apr 23 European stock markets close higher

- April 23 Closing call: AEX closes sharply higher again and ASMI increases festive spirit

- Apr 23 ASMI significantly increases margin

IEX also produces an overview of the most important news in the morning newspapers every morning. The complete news overview can be found here.

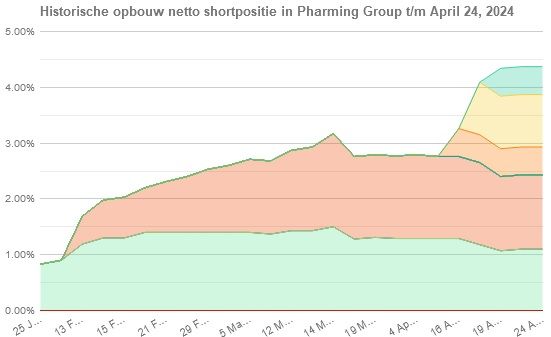

The AFM reports these shorts.

Here Pharming:

Recommendations: buying advice for Akzo Nobel

Fan mail for Akzo Nobel:

- Akzo Nobel: to €84 from €74 and hold advice makes way for buy advice – Sanford C. Bernstein & Co

- IMCD: to €156 from €149, but advice remains – HSBC

Agenda: Meta and IBM (but please be patient)

You have seen the figures for Heineken, Vopak, Wereldhave, KPN and MotorK. After the afternoon sandwich, Boeing and AT&T follow. For more fireworks, set the alarm for 10 p.m., when Meta and IBM come through.

The share of AEX heavyweight ING goes €0.756 ex-dividend.

The macroeconomic agenda does not amount to much. The German Ifo index (indicator of business confidence) is the most exciting.

Here is the full agenda for the rest of the day:

- 09:00 ING €0.756 ex-dividend

- 00:00 ABN AMRO – annual meeting

- 00:00 ASML – annual meeting

- 00:00 WDP – annual meeting

- 00:00 Intervest – annual meeting

- 00:00 Van de Velde – annual meeting

- 10:00 Tue, Ifo business confidence index April

- 1:00 PM AT&T first quarter results

- 1:00 PM Boeing first quarter results

- 1:00 PM Hasbro first quarter results

- 1:00 PM US mortgage applications – weekly

- 13:30 Vastned Belgium – Annual meeting

- 2:30 PM US orders for durable goods in March

- 4:30 PM US Oil Stocks – Weekly

- 10:00 PM IBM first quarter results

- 22:00 Meta figures first quarter

And then this:

4 reasons to invest in lithium (although some are based on assumptions:

The longer US interest rates remain high, the more of a problem it becomes:

Hurrah

You’ve caught up again. Good luck and above all have fun today!

Tags: AEX processes avalanche figures cheerfully Musk talks Teslas price

-