Bitcoin bulls continue to pressure the price to $70,000 or higher, while whales jumped in and bought the dip.

Bitcoin liquidity

A large order book with many buy and sell orders at different price levels contributes to high liquidity. This means that there is always a counterparty for both buy and sell orders. If a market is liquid, large transactions do not lead to large price fluctuations. And that is nice for entities that want to place large orders at a certain price level.

Bitcoin price action is circling around $67,000 after a boost at the close of the day on Tuesday. The range between buy and sell orders is still quite narrow, but the bitcoin bulls continue to push nearby liquidity. Figures from analysis company CoinGlass show that a bid wall of approximately $35 million was swallowed up at the day’s closing. Most of the liquidity is between $67,000 and $67,500.

What does Material Indicators analyst say on X? Based on trading orders on a monthly basis, he sees that placing orders at certain price levels (liquidity) logically has a significant influence on the price action. These orders fall as soon as the price ‘touches’ these orders.

An accompanying graph additionally showed trading behavior among bitcoin whales, entities with 1,000 or more BTC. Interesting is the order category of $1-$10 million, which, unlike other entities, opted for more exposure in April.

According to research agency Santiment, there is even ‘fear of missing out’ (FOMO) among whales. Particularly those with wallets with balances between 1,000 and 10,000 BTC ($66.7 million — $667 million).

“Bitcoin’s major whale class with 1K-10K $BTC is supporting this increase, having now accumulated 266K more $BTC since the start of 2024,” https://twitter.com/santimentfeed/status/1782954556013547562 Santiment on

Boring price promotion

According to trading firm QCP Capital, there has been a “disturbing lull” as crypto markets enjoyed a final period of low volatility before a seismic shift. In an update on the Telegram channel, they report the following: “BTC is right in the middle of the 60/73k range and the short-term derivatives will expire soon, which could cause volatility.

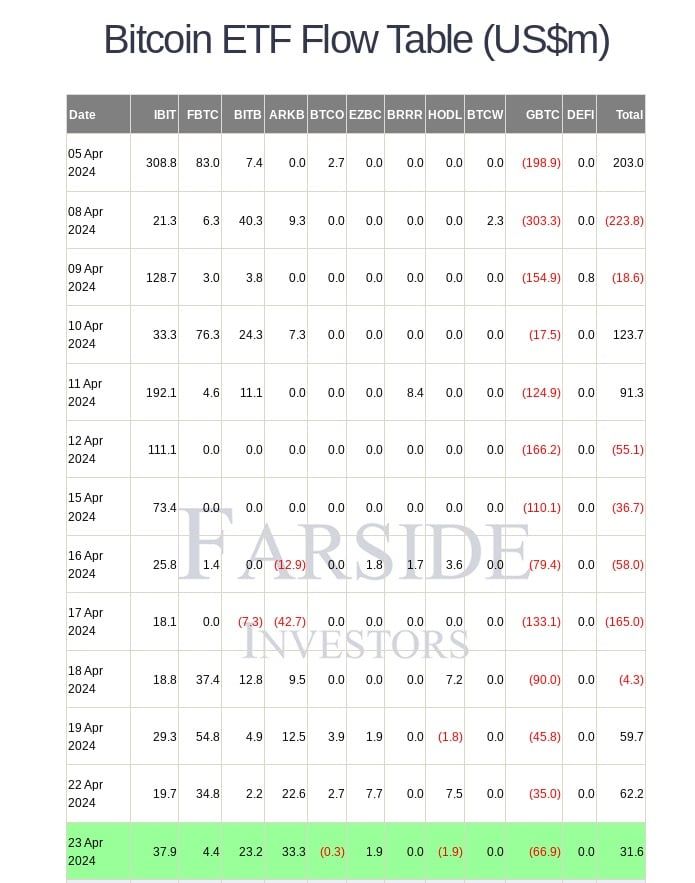

Analysts point to the reset in bitcoin funding rates and a slow but steady return of interest to US spot Bitcoin exchange-traded funds (ETFs).

“Demand from TradFi continues to flow in, albeit at a slower pace with BlackRock posting 70 consecutive days of inflows,” the update concludes.

And trading in bitcoin ETFs will also start soon in Asia, Bitcoin Magazine.com reports today on X.